1099-NEC

1099-NEC

1099-NEC (nonemployee compensation) is an IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee. Such nonemployees are commonly independent contractors, and may also include payments made to other service providers such as attorneys. Generally, Forms 1099-NEC are required to be filed if at least $600 in payments were made to independent contractors for services performed, or were cash payments for fish purchased from a seller engaged in the trade or business of selling fish. However, there are other payments for which Forms 1099-NEC are required. We also offer 1099-NEC envelopes that coordinate with the different forms. Filing Deadlines for 1099-NEC

1099-NEC 3-Up Individual Federal Copy A

• 3-Up Federal Copy A

• Laser cut sheet

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 3 forms

• Comes in pack of 150 forms

• Compatible envelopes are L1002 and L1010

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 150.

1099-NEC 3-Up Individual Recipient Copy B

• 3-Up Copy B for Recipients' records

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 3 forms

• Comes in pack size of 150 forms

• Compatible envelopes are L1002 and L1010

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 150.

1099-NEC 3-Up Copy 2 and/or 1

• 3-Up State Copy or Extra File Copy

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 3 forms

• Comes in pack size of 150 forms

• Compatible envelopes are L1002 and L1010

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 150.

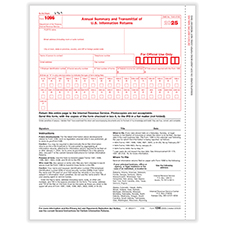

1096 Laser Transmittal

• Includes 1096 transmittal forms to show the totals of the information returns that you are physically mailing to the IRS

• Use to transmit paper forms 1098, 1099, 3921, 3922, 5498 and W-2-G to the IRS

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Offered in pack sizes of 10 and 25

• Previous SKU was L0121

1099-NEC 3-Up 3-Part Set

• 3-Up 3-Part form set contains Copies A, B, and C/2

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 3 forms

• Pack of 50 forms

• Compatible envelopes are L1002 and L1010

1099-NEC 3-Up 4-Part Set

• 4-Part set contains Copies A, B, and C/2

• Laser cut sheets

• 3 1096 Transmittal Forms included

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack sizes of 25 and 50 forms

• Compatible envelopes are L1002 and L1010

1099-NEC 3-Up 5-Part Set

• 3-Up 5-Part form set contains Copies A, B, C, C and 2

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 3 forms

• Comes in pack of 50 forms

• Compatible envelopes are L1002 and L1010

1099-NEC Recipient Copy Only 3-Part with Envelopes

• 1099-NEC set includes copies B, C/1/2 and self-seal envelopes

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 3 forms

• Comes in pack sizes of 25 and 50 forms

1099-NEC 3-Up 3-Part Set w/ Self-Seal Envelopes

• 3-Up 3-Part form set contains Copy A, B and C with self-seal envelopes

• 3 1096 Transmittal Forms included

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

•1 page equals 3 forms

• Pack of 25 or 50 forms

1099-NEC 3-Up 4-Part Set with Self-Seal Envelopes

• 3-Up 4-Part form set contains Copy A, B, and C with self-seal envelopes

• Laser cut sheets

• 3 1096 Transmittal Forms included

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 3 forms

• Comes in packs of 25 and 50 forms

1099-NEC 3-Up Pressure Seal 11" Z-Fold

• 2-up horizontal 11” Pressure seal form with Copy B backer instructions

• Produced on Quality 28# paper to ensure trouble-free printing and folding

• Z-Fold format

• Pack of 500 forms

1099-NEC 3-Up Blank w/Recipient Copy B with Backer Instructions

• 3-Up blank form contains recipient Copy B with Backer Instructions

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 3 forms

• Comes in pack size of 150 forms

• Compatible envelopes are L0309

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 150.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

1099-NEC Blank, Copy B & 2/1, 3-Up, w/ Backer

• 3-Up blank forms contain Copies B and 2/1 includes Backer Instructions, horizontal format

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack size of 25, 50, or 500 forms

• Compatible envelope is L1018

1099-NEC 2-Up Pressure Seal, Blank w/ Backer, Z-Fold, 11"

• 2-up horizontal 11” Pressure seal form

• Produced on Quality 28# paper to ensure trouble-free printing and folding

• Z-Fold format

• Pack of 500 forms

1099 Double-Window Envelopes 3-Up (Gummed)

• Double-window envelope accommodates all standard IRS 3-Up 1099 formats

• Overall size: 3-7/8" x 8 7/8" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x7/8" - Position: 1/2" from left; 2-1/4" from bottom

• Bottom window size: 3-3/8" x 1-1/16" - Position: 1/2" from left; 11/16" from bottom

• Moisture/gum-seal flap

• Manufactured on 24# white wove paper

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0114

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.

1098 Double Window Envelopes 3-Up (Self-Seal)

• Double-window envelope accommodates all standard IRS 3-Up 1099 formats

• Overall size: 3-7/8" x 8 7/8" - Windows display both Payer and Recipient name and address

• Top window size: 3-3/8" x7/8" - Position: 1/2" from left; 2-1/4" from bottom

• Bottom window size: 3-3/8" x 1-1/16" - Position: 1/2" from left; 11/16" from bottom

• Self-seal flap

• Manufactured on 24# white wove paper

• Offered in pack sizes of 25, 50, and 500

• Previous SKU was L0228

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 25.