W-2 Forms

W-2

Use Form W-2 if you have employees to report their annual wage payments made in the course of your trade or business. In addition to reporting income tax withheld based on your employees’ elections, Forms W-2 should report the amount of wages subject to both Social Security and Medicare tax, as well as Additional Medicare Tax, if applicable. Forms W-2 also report other types of qualified compensation or employment benefits in various boxes which may be excluded from an employee’s taxable income, such as employer’s contribution to an employee’s Health Savings Account or employer contributions to a qualified retirement plan. We also offer W-2 envelopes that coordinate with the different forms. Filing Deadlines for W-2

W-2 2-Up Federal IRS Copy A

• 2-Up form contains Federal Copy A for filing to the SSA

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 3 transmittal forms included

• Comes in pack sizes of 10, 100 and 1000 forms

• Compatible envelopes are L1016 and L0301

W-2 2-Up Employee IRS Federal Copy B

• 2-Up form set contains Employee Copy B which is to be filed with Federal Tax Return

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers.

• Comes in pack sizes of 1000 forms

• Compatible envelopes are L1016 and L0301

W-2 2-Up Employee Copies 2 & C

• 2-Up Horizontal-style form set contains Employee Copies C and 2

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack sizes of 10 and 1000 forms

• Compatible envelopes are L1016 and L0301

W-2 2-Up Employer Copies D and/or State, City, Local

• 2-Up form set contains Employer Copies D and/or State, City, Local

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack sizes of 10 and 100 forms

• Compatible envelopes are L1016 and L0301

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 10.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

W-2 4-Up Employer Copies 1/D - Horizontal

• 4-Up Horizontal-style form contains Employer Copies 1/D, 1/D, 1/D and 1/D

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 form equals 1 employee

• Pack size of 100 forms

• Compatible envelopes are L1003 and L1004

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 100.

W-2, 4-Up Box, Employer Copy D or 1 State/City or Local (W Style)

• W-2 W-Style 4-Up Employer Copies - Box

• 4-Up box form contains employer Copy D or 1

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 4 forms

• Compatible envelopes are L1007 and L1008

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

W-2 4-Up Employer Copies 1/D - Box

• 4-Up Box-style form contains Employer Copies 1/D, 1/D, 1/D and 1/D

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 form equals 1 employee

• Pack of 100 forms

• Compatible envelopes are L1000 and L1001

W-2 4-Up Employee Copies B, C, 2 & 2 Combined - Box

• 4-Up Box-style form set contains Employee Copies B, C, 2 and extra file copy

• Includes employee information on back of form

• Laser cut sheet

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack sizes of 50 and 100 forms

• Compatible envelopes are L1000 and L1001

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

W-2 4-Up M-Style Alternate Employee’s Copies B, C, 2, 2

• W-2 4-Up M-Style Alternate Employee Copies B, C, 2 & 2 Combined - Box

• 4-Up M-style alternate form set contains Employee Copies B, C, 2 and extra file copy

• Includes employee information on back of form

• Laser cut sheet

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 4 forms

• Pack size of 50 forms

• Compatible Envelope is L0310

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

W-2 4-Up Perforated Employee Copies B, C, 2 & 2 Combined - Horizontal

• 4-Up Horizontal-style form contains Employee Copies B, C, 2 and extra file copy

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack sizes of 50 and 100 forms

• Compatible envelopes are L1003 and L1004

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

W-2 3-Up Perforated Employee Copies B, C and 2 - Horizontal

• 3-Up Horizontal-style form set contains perforated Employee Copies B, C, and 2

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack of 500 forms

• Compatible envelopes are L1005

W-2 4-Up W-Style Alternate Employee’s Copies B, C, 2, 2

• W-2 4-Up W-Style Alternate Employee Copies B, C, 2 & 2 Combined - Box

• 4-Up W-style alternate form set contains Employee Copies B, C, 2 and extra file copy

• Includes employee information on back of form

• Laser cut sheet

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 4 forms

• Comes in pack sizes of 50 and 100 forms

• Compatible envelopes are L1007 and L1008

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

If you are ordering more than 10,000 forms, please contact service@formstax.com for custom pricing.

W-3 Transmittal of Income

• W-3 Laser Transmittal Form for W-2 Filings

• Includes W-3 transmittal forms to show total earnings, Medicare wages, Social Security wages, and withholding for all employees encompassing the entire year

• Used to summarize W-2 forms, W-3 forms are filed only when paper Copy A of form W-2 is being filed

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack sizes of 10 and 25

• Previous SKU was L0123

TaxRight W-2 4-Part Laser Kit with Envelopes & Software

• Package contains Copy A, B, C and D with self-seal envelopes

• Contains TaxRight tip sheet to take the guesswork out of filing forms. Includes minimum requirements, penalties, common errors and employers do's and don’ts of filing.

• Software CD included, download option available after purchase

• 3 Transmittal Forms included

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack size of 10 forms

• Free e-filing not included with purchase

• System requirements listed below

TaxRight W-2 6-Part Laser Kit with Envelopes & Software

• Package contains Copy A, B, C, 2, D and 1 with self-seal envelopes

• Contains the TaxRight Tip Sheet to take the guesswork out of filing forms. Includes minimum requirements, penalties, common errors and employers do's and don'ts of filing.

• Software CD included, download option available after purchase

• 3 Transmittal Forms included

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Comes in pack size of 10 forms

• Free e-filing not included with purchase

• System requirements listed below

Blank W-2 4-Up Vertical and Horizontal Perforated with Envelopes and Software

• Blank W-2 4-Up Box style forms offer 4 copies per sheet for quick use in a laser printer and envelopes

• Includes instructions on back of forms

• Software CD included, download option available after purchase

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 4 forms

• Comes in pack of 50 forms

• Free e-filing not included with purchase

• System requirements listed below

W-2 2-Up Recipient Copy Only 5-part with Self-Seal Envelopes and Software

• W-2 set includes copies B, C/2, D/1 and self-seal envelopes

• Laser cut sheets

• Software CD included, download option available after purchase

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack of 50 forms

• Free e-filing not included with purchase

• System requirements listed below

Blank W-2 Perforated with Self-Seal Envelopes and Software

• Blank 2-Up form contains one center perforation and no Instructions and self-seal envelopes

• Laser cut sheets

• Software CD included, download option available after purchase

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack of 50 forms

• Free e-filing not included with purchase

• System requirements listed below

W-2 2-Up Recipient Copy Only 3-Part with Self-Seal Envelopes

• W-2 set includes copies B, C/2, D/1 and self-seal envelopes

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 1 page equals 2 forms

• Comes in pack size of 25 forms

W-2 2-Up 4-Part Set with Self-Seal Envelopes

• 2-Up 4-Part form set includes Copies A, B, C, and D with self-seal envelopes

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 3 transmittal forms included

• Comes in pack sizes of 10 forms

W-2 2-Up 6-Part with Gummed Envelopes

• 2-Up 6-Part form set includes Copies A, B, C, D, 1 and 2 with gummed envelopes

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 3 transmittal forms included

• Pack of 100 forms

W-2 2-Up 6-Part Set with Self-Seal Envelopes

• 6-Part, 2-Up Horizontal form set contains Copies A, B, C, D, 1 and 2 with self-seal envelopes

• Laser cut sheet

• Printed with heat-resistant ink for use with most inkjet and laser printers

• 3 transmittal forms included

• Comes in pack sizes of 50 forms

W-2 6-Part Carbonless Copy A, 1/D, B, C, 2, 1/D

• W-2 Continuous 1" Wide 6-Part

• 6-Part set form contains Employee Copies A, 1/D, B, C, 2 and 1/D

• Continuous pin feed

• Sold in packs of 25

• Continuous forms printed on carbonless black print paper for clear data transfer between copies

• Compatible envelopes are L1016 and L0301

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered.

W-2 Continuous Twin Set 6 Part

• 6-Part Employee form combination set

• Contains one Employer 3-Part set and one Employee 3-Part set

• Continuous pin feed

• Sold in packs of 25

• Continuous forms printed on carbonless black print paper for clear data transfer between copies

• Compatible envelopes are L1016 and L0301

W-2 4-Up Box Pressure Seal 14" Z Fold Employee Copies B, C, 2 or extra copy

• 4-Up Box-style 14" Pressure Seal form includes Copies B, C, 2 or extra copy

• Includes employee instructions on back of form

• Eccentric Z-Fold, No envelopes are required.

• Produced on quality 28# paper to ensure trouble-free printing and folding.

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack size of 500 forms

W-2 4-Up Pressure Seal 14" EZ-Fold Employee Copies B, C, 2 - Horizontal

• 4-Up Horizontal-style form contains Employee Copies B, C, 2 and 2

• Includes employee instructions on back of form

• Pressure Seal Eccentric Z-fold form does not require envelopes

• Produced on quality 28# paper to ensure trouble-free printing and folding

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Pack of 500 forms

W-2C Federal Copy A

• 1 form per sheet

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Compatible Envelope is L1020

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

W-2C Recipient Copy B

• W-2C Employee Copy B

• 1 form per sheet

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Compatible Envelope is L1020

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

W-2C 4-Part Set

• 2-Up 4-Part form set includes Copy A, B, C and D

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Compatible envelopes are L1020

W-2C Copy 2 or C

• W-2C Employee Copy 2 or C

• 1 form per sheet

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Compatible Envelope is L1020

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

W-2C Copy 1 or D

• W-2C Employer State, City or Local Copy 1 or D

• 1 form per sheet

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers

• Compatible Envelope is L1020

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 50.

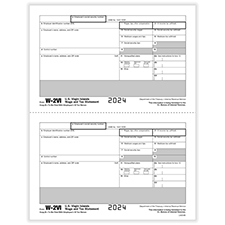

W-2VI 2-Up Recipient Copy B Pre-Printed

• W-2VI 2-Up Employee IRS Federal Copy B

• Report U.S. Virgin Island wages

• 2-Up form set contains Employee Copy B which is to be filed with Federal Tax Return

• Laser cut sheets

• Printed with heat-resistant ink for use with most inkjet and laser printers.

• Compatible envelopes are L1016 and L0301

This product offers tiered pricing, giving a lower price per form when you increase the quantity ordered. The table below shows pricing for Pack Size = 100.

- 1

- 2